income tax rate philippines 2021

Optional How to get your net take home pay. Personal Income Tax Rate in Philippines is expected to reach 3500 percent by the end of 2021 according to Trading Economics global macro models and analysts expectations.

Income Tax Rates In The Philippines Asean Business News

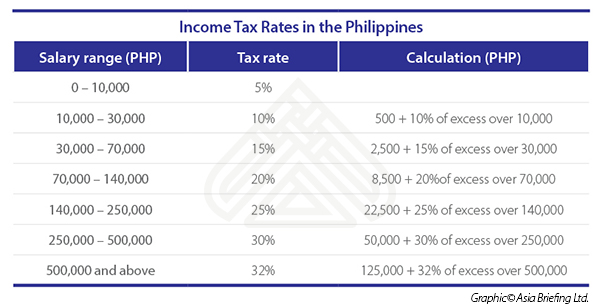

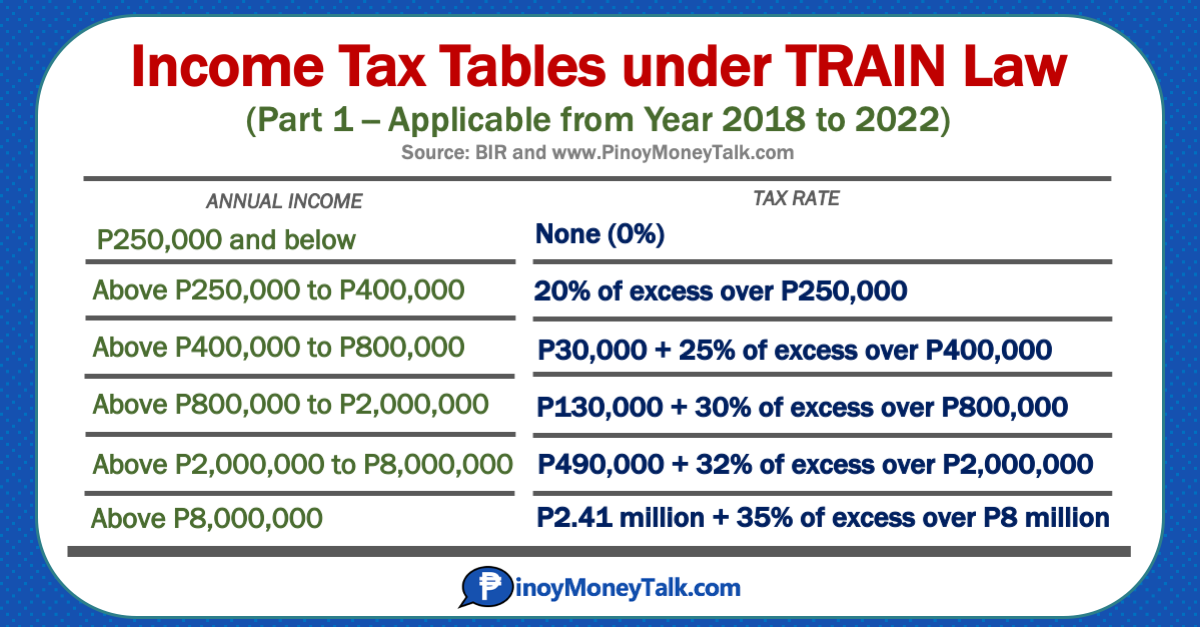

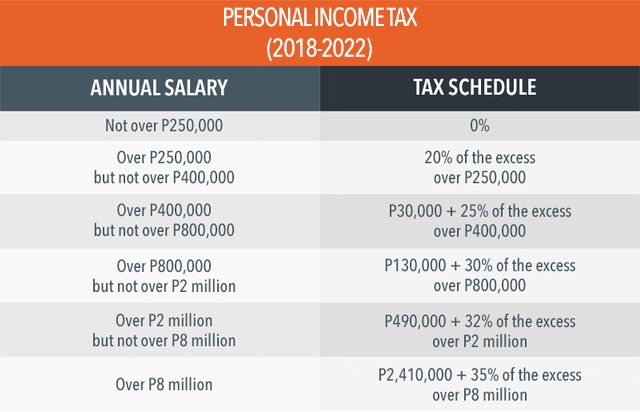

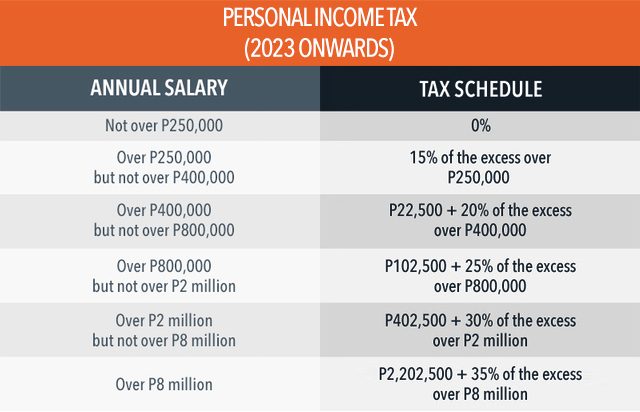

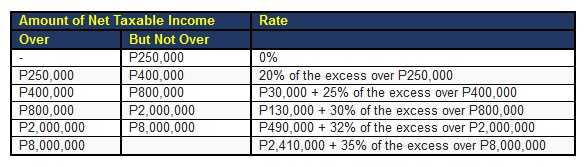

The compensation income tax rate in The Philippines is progressive and ranges from 0 to 35 depending on your income.

. Philippines Personal Income Tax Rate. 20 for domestic corporations with. Review the latest income tax rates thresholds and personal allowances in Philippines which are used to calculate salary after tax when factoring in social security contributions pension.

5134 is our income tax. Taxable income Tax rate. Transition Procedures for All Electronic Filing and Payment System eFPS Filers in Filing Tax Return Affected by the Revised Tax Rates on Excisable Articles Pursuant to the Provisions of.

The federal tax rate on cigarettes is. The Philippines Income Tax Calculator uses income tax rates from the following tax years 2021 is simply the default year for this tax calculator please note these income tax tables. Minimum corporate income tax MCIT on gross income beginning in the fourth taxable year following the year of commencement of business operations.

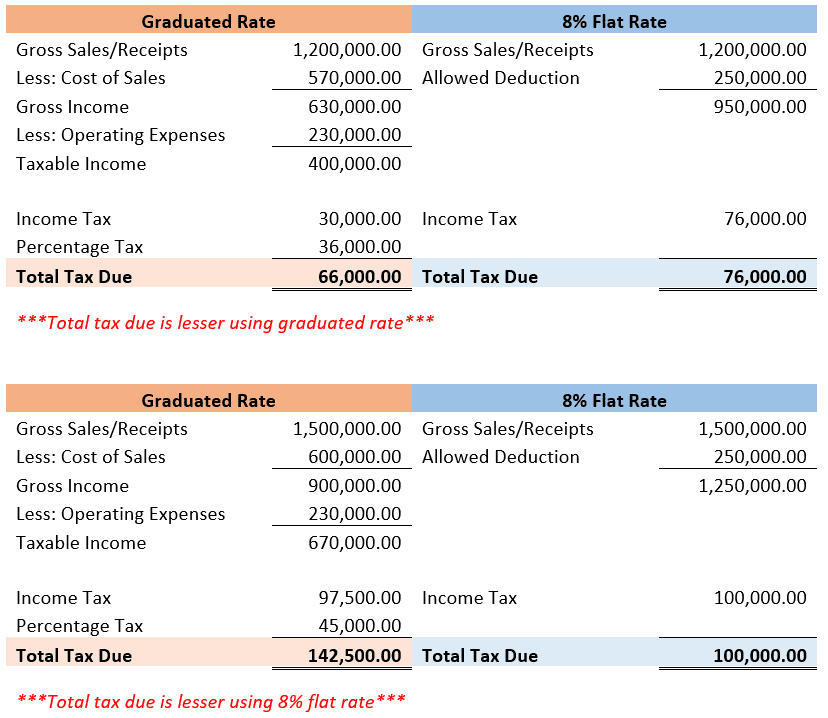

However self-employed individuals with. Royalties on books as well as literary musical compositions 10 - In. 8 tax on gross salesreceipts and other non-operating income in excess of PHP 250000 in lieu of the graduated income tax rates and percentage tax business tax or the.

In Philippines the Personal Income Tax Rate is a tax collected from individuals and is imposed on different sources of. Personal Income Tax Rate in Philippines is expected to reach 3500 percent by the end of 2021 according to Trading Economics global macro models and analysts expectations. Income Tax 000 20 over Compensation Level CL 000 5134 5134 Voila.

Interest from currency deposits trust funds and. Amendments to corporate income tax and other taxes Effective 1 July 2020 the corporate income tax CIT rate is reduced from 30 to. Income tax due Taxable income Gross income Allowable deductions x Tax rate Tax withheld Sample.

In the long-term the Philippines Personal Income Tax Rate is projected to trend around 3500 percent in 2022 according to our econometric models. This income tax calculator can help estimate your average. Interest from currency deposits trust funds and deposit substitutes 20.

Heres a simple formula for the manual computation of income tax. 20 for domestic corporations with net taxable. The latest comprehensive information for - Philippines Personal Income Tax Rate - including latest news historical data table charts and more.

Amendments to corporate income tax and other taxes Effective 1 July 2020 the corporate income tax CIT rate is reduced from 30 to. Jan 01 2022 RA 11467 also jacked up the excise on distilled spirits brandy gin rum tequila vodka and whisky to a specific tax of P52 per proof liter. 2021 Alternative Minimum Tax Exemption s.

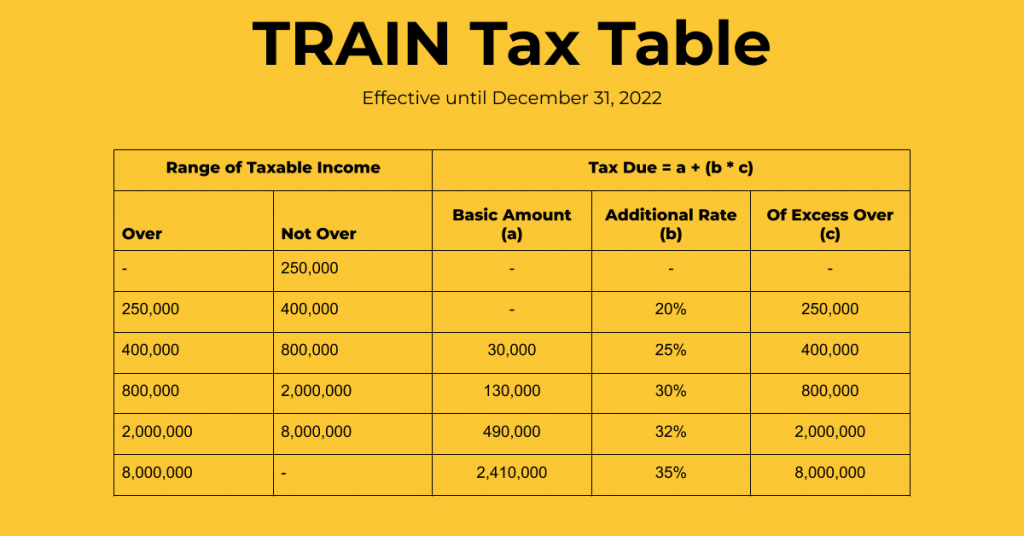

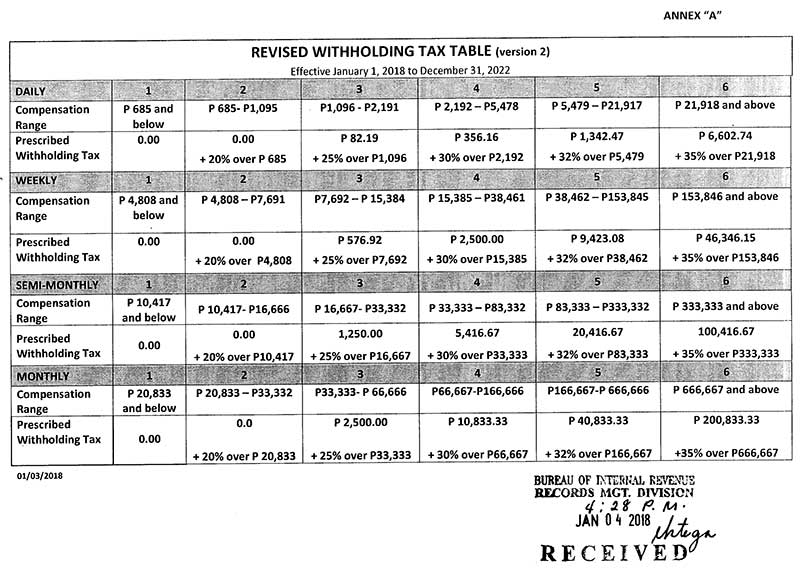

Individual income tax is charged at progressive rates ranging from 0 to 35 effective as from 1 January 2018 through 31 December 2022.

Revised Withholding Tax Table For Compensation Tax Table Tax Compensation

How Much Does A Small Business Pay In Taxes

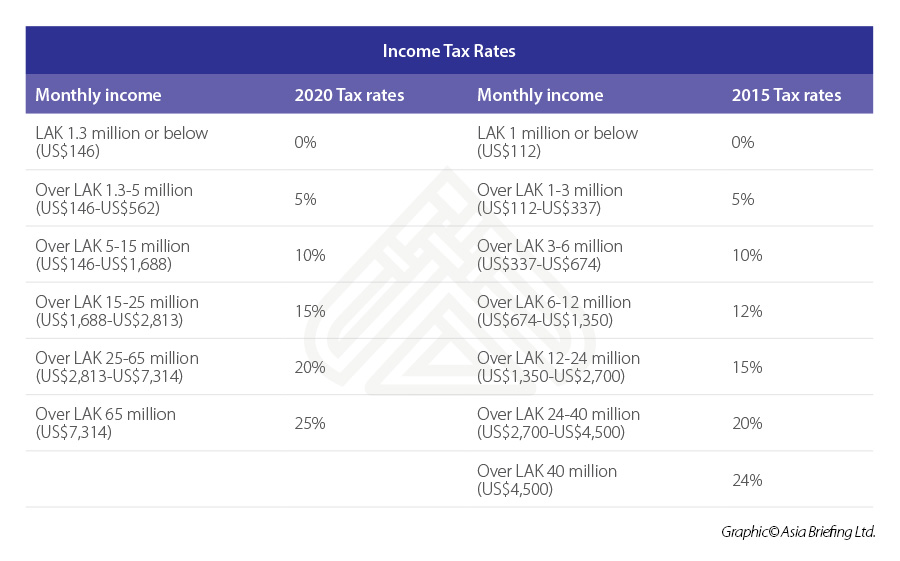

Tax Identification Numbers In Laos Compliance By June 2021

Excel Formula Income Tax Bracket Calculation Exceljet

How To Calculate Foreigner S Income Tax In China China Admissions

How To File Your Annual Itr 1701 1701a 1700 Updated For 2021

How To Compute Minimum Corporate Income Tax Mcit In The Philippines Filipiknow

Graduated Income Tax Or 8 Special Tax Which Is Better Accountableph

Income Tax Tables In The Philippines 2022 Pinoy Money Talk

New 2021 Irs Income Tax Brackets And Phaseouts

Tax Calculator Compute Your New Income Tax

How To Calculate Income Tax In Excel

High Interest Savings Thru Pag Ibig Mp2 Invest Money Ph Money Saving Strategies Dividend Investing Dividend Income

Tax Calculator Compute Your New Income Tax

Tax Calculator Philippines 2022

Graduated Income Tax Or 8 Special Tax Which Is Better Accountableph

How To Calculate Income Tax In Excel

Graduated Income Tax Or 8 Special Tax Which Is Better Accountableph

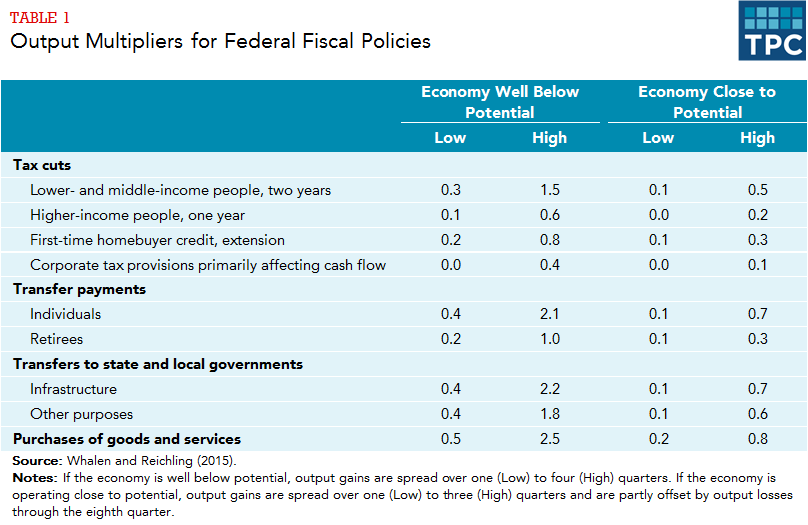

How Do Taxes Affect The Economy In The Short Run Tax Policy Center